Low Value Invoice Analysis User Guide

Business organisations can spend large amounts of time and expense processing low-value invoices. As of February 2022, the global average cost to process a single invoice is set at between £5 to £25, with the average cost being £15 ($US 20) (DnB website). The consolidation of low-value invoices can be a worthwhile money-saving exercise. The Rosslyn Platform includes a ‘What If……’ analysis tool for just this purpose.

Sample Scenario

Let's consider our business activities with Supplier ‘A’.

On average we process around 800 invoices covering spend with Supplier ‘A’ per year. Due to the type of goods and services supplied, we know that about 60% of those 800 invoices are below £10 in value. The cost to process a single invoice is £15. We are incurring processing costs processing low-value invoices from this Supplier, on average around 480 invoices per year at a cost of (480 X £15 = £7,200).

One solution is to set a limit on the value of an invoice (instead of a single low-value invoice, consolidate the invoices into a new consolidated value). For example, if we process an invoice from Supplier ‘A’ only when it totals £100. Our costs are still £15 per invoice. Supplier ‘A’ will need to consolidate their low-value (£10) invoices into a single itemised invoice with a total value of more than £100 before we process it. This makes perfect commercial sense. Our overall costs to process are now being targeted correctly. Potential savings can be identified, and our processes have remained largely unaffected.

Analysing Low-Value Invoices

Navigate to the ‘Spend Dashboard: Summary – Main Overview’

Navigate to the ‘Summary’ Menu on the right and select the ‘Compliance: Low-Value Invoices’ sheet

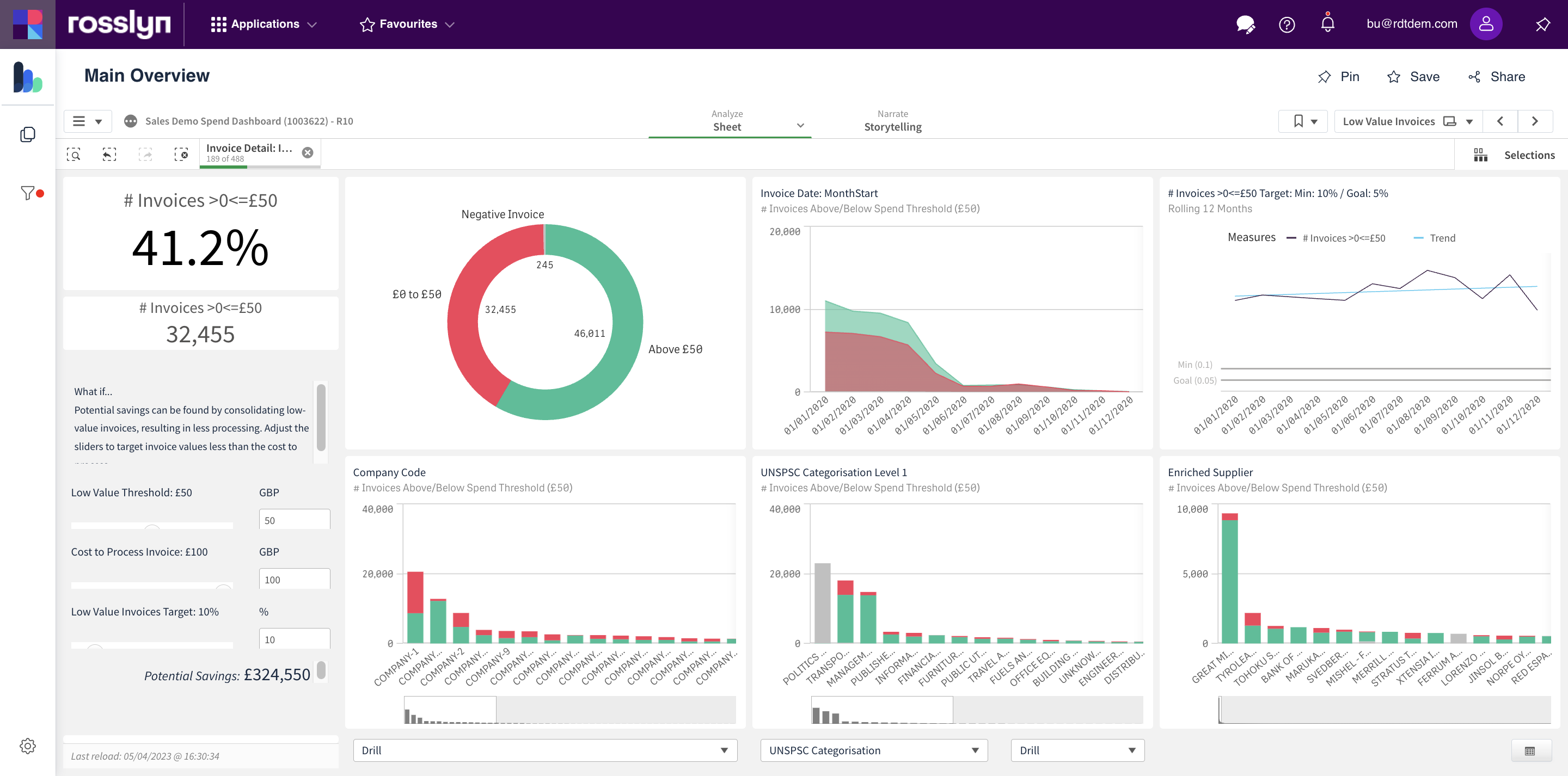

The ‘What If……’ scenario analysis tool is situated on the left of the screen.

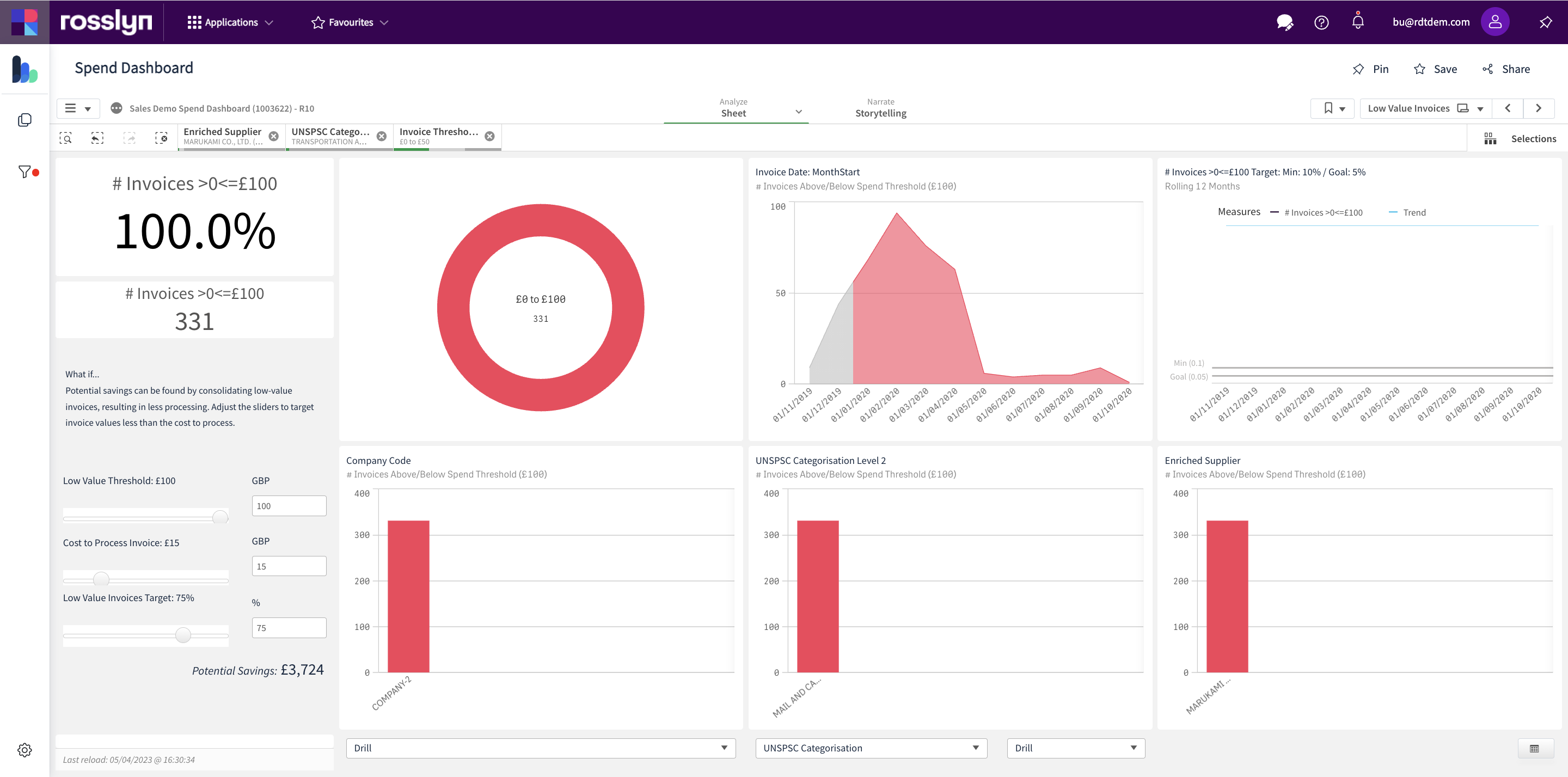

Example Low-Value Invoice Analysis

- In this example, we will analyse low-value invoices from a single supplier over a set period. The time span will be one year.

- The default setting for ‘Low-Value’ invoices is £50. Selecting the ‘Low-Value’ segment from the ‘Doughnut’ chart and applying it as a filter, the charts are now focused on invoices below that minimum value per invoice.

- The business category ‘Transport and Storage and Mail’ has been selected and applied as a filter. From that category, the Supplier ‘MARUKAMI Co’ with 331 low-value invoices below £50 has been selected and applied as a filter.

- The costs to process a single invoice is £15. Therefore, the cost to the business organisation in processing 331 low-value invoices (below £50 in this example) in a one-year period is (331 X £15 = £4,965)

- Using the Sliders or the text boxes in the ‘What If……’ analysis tool, reset the ‘Low-Value Threshold’ to £100.

- Reset the ‘Cost to process Invoices’ to £15.

- By introducing these measures, we could reduce the number of Low-Value Invoices from this Supplier by 75%. Reset the ’Low Value Invoices Target’ to 75.

- In this example, albeit based on demo data, the ‘What If……’ analysis tool has indicated a potential saving of £3,274, based on a comparable period and spend activity over the next 12-month period.

Note: This working example can be adapted to suit users and business organisations needs to analyse the impact of low-value Invoices.